Net Lease Dollar Store Report Published Date August 2, 2017

The Boulder Group’s Research Department has released a new net lease dollar store report providing comprehensive numbers and analysis of the recent activity in the National Net Lease Dollar Store Market.

Highlights from the report are as follows:

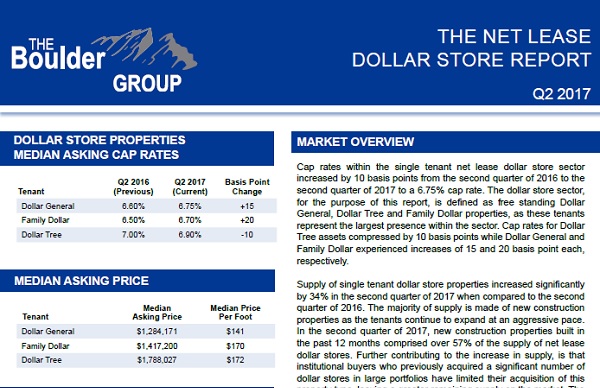

- Overall cap rates for Dollar General, Family Dollar and Dollar Tree properties experienced an increase in cap rates of 10 basis points

- New construction Family Dollar properties represent the lowest cap rate in the sector

- Dollar stores are priced at a 52 basis point discount when compared to the entire net lease retail market

The full report can be viewed online at http://www.bouldergroup.com/media/pdf/Net-Lease-Dollar-Store-Research-Report.pdf

About The Boulder Group

The Boulder Group is a boutique investment real estate service firm specializing in single tenant net lease properties. The firm provides a full range of brokerage, advisory, and financing services nationwide to a substantial and diversified client base, which includes high net worth individuals, developers, REITs, partnerships and institutional investment funds. Founded in 1997, the firm has arranged the acquisition and disposition of over $4 billion of single tenant net lease real estate transactions. In 2011-2016, the firm was ranked in the top 10 companies in the nation for single tenant retail transactions by both Real Capital Analytics and CoStar. The Boulder Group is headquartered in suburban Chicago. More information on the firm can be found on The Boulder Group’s website at www.bouldergroup.com

Back